Bespoke solutions to awkward spaces save money in the long run

Budgeting for a home renovation can be a stressful and challenging experience. Most people don’t have a huge amount of cash hanging around and chances are your budget won’t stretch to exactly what you want to do. These are some of our best tips for developing your home building budget through from schedule to items you can leave till later.

The Schedule

So what is the best order to purchase items to make the most of your cash? What has to be bought up front and what can wait?

Just picked up the keys to your brand new home and don’t know where to begin?

The traditional spending pattern on a refurbishment requires you to be stumping up a large sum at the beginning, a steady stream of bills at the middle, with a retainer held until completion. If you are struggling with cash flow you can reduce the size of the initial payment by arranging to purchase ‘non fixed’ items at a later date, say after your bonus has come in.

Items to be purchased at the initial stages:

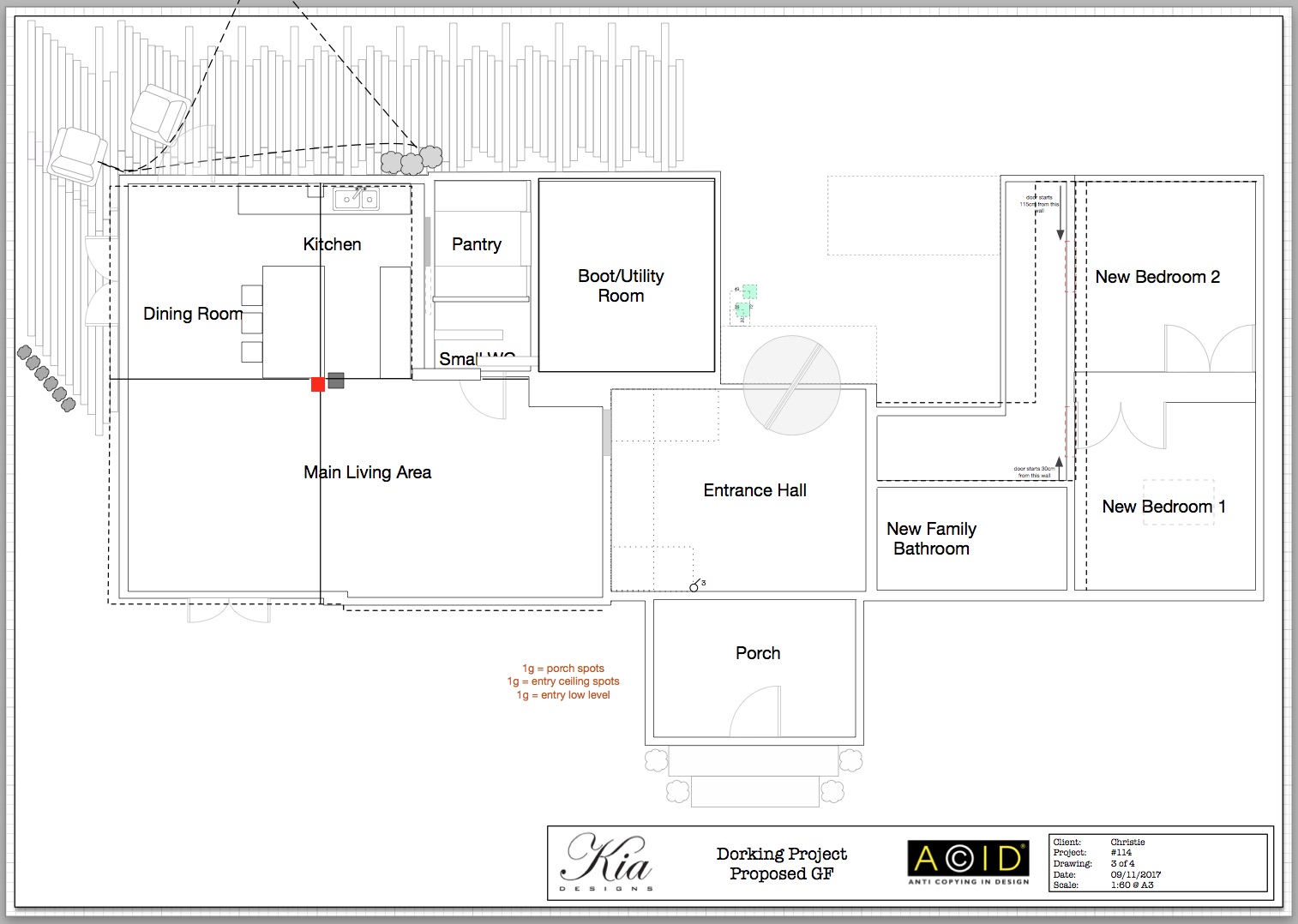

The Design

If you are using an Interior Designer, or even if you are doing it yourself, know what needs to go where. It saves time as the builders won’t have to waste time measuring, guessing or changing the position of items later. The design creates Tender Docs and that is what your builder will be quoting from. No documents – no exact quote. A sure budget killer.

The general building works

Builders will need upfront payment for materials required and then a weekly/fortnightly laybour wage.

‘Fixed items’

ie anything that can’t be picked up and taken away. This would include flooring, tiling, baths, sinks, toilets, kitchen cabinets, boilers etc

Bespoke joinery is a hefty investment, but really pays dividends if you have an awkward or small space

What can be bought later?

- The majority of the furniture. You can always live with your current bed, or grab a Freecylce sofa until the one you really want hits the sale.

- Storage. Built in or free standing. Good storage always costs more than people think, and it is a good idea to wait until you can invest accordingly. Built-in doesn’t have to be done at the initial building stage, but be aware if you want internal lighting you would need to mention that to your builders at the start of the project to they can prepare wiring.

- Window dressings. A cheap blind can be bought for as little at £35 (I’m not saying it will be nice). This would adequately block out the light in a bedroom until you save up to have curtains and a pelmet made.

- Whilst you cannot avoid hard wiring lights in, lampshades are expensive. If you can cope with having a ‘naked’ chandelier for a few months, you postpone the output of about £600.

- If you want to splash out on hardware, you can do that later. Cheap door handles, kitchen cabinet knobs even electrical face plates are easily changed at a later date. The basic range from somewhere like Ikea or B&Q will cost virtually nothing.

- Appliances. You can always get 2nd hand electrical kitchen appliances, just make sure they are of a similar size to your desired models

If you have any other questions about how you could save money, or rejig your finances, please don’t hesitate to get in touch.